Learn how to change mobile number in bank account easily. Follow our clear, simple step-by-step instructions to ensure a smooth and uninterrupted banking services.

In today’s fast-paced world, our phone numbers often switch, like clothes for the changing seasons. A new job, a network change, or simply that irresistible “unlimited data” deal – whatever the reason, maintaining our connection with our bank accounts through the correct mobile number is crucial. So, when that new SIM card finds its home in your phone, how do you ensure your bank knows where to reach you? Don’t worry, updating your mobile number linked to your bank account is a straightforward process. This guide will walk you through the different ways you can change mobile number in bank account, depending on your bank and preferred method.

Why Change Mobile Number in Bank Account?

There are several reasons why you might need to update your phone number linked to your bank account:

- Switching phone carriers: New phone, new number!

- Lost or stolen phone: Protecting your financial information is crucial.

- Upgrading your phone: Say goodbye to those cracked screens and hello to a new device.

- Moving to a new location: Your area code might change along with your address.

- Security concerns: Maybe you suspect unauthorized access attempts.

Before You Update:

- Gather your information: Have your current account number, new phone number, and any relevant identification documents handy.

- Back up your old phone: If you’re switching devices, transfer important data like contacts and messages.

- Inform your bank: Let them know about your intention to change your number, especially if you’re using online banking or mobile apps.

Understanding the Options: A Branch, a Click, or a Call

The good news is, the prcess to change mobile number in bank account isn’t like scaling Mount Everest – there are multiple paths to the summit, each catering to different preferences and comfort levels.

- Visiting Your Bank Branch: This is the traditional method, perfect for those who prefer personal interaction. Simply visit your nearest branch, fill out a mobile number update form (provided by the bank), and present your identification documents. The bank representative will process your request, and you’ll receive confirmation within a few days.

- Online Banking: Most banks offer online banking platforms where you can manage your account information. Log in, navigate to your profile settings, and locate the option to update your mobile number. Enter your new number and follow the on-screen instructions. Some banks might require additional verification through a one-time password (OTP) sent to your old or new number.

- Mobile Banking App: If you frequently use your bank’s mobile app, check if it offers mobile number update functionality. Open the app, log in, and look for settings or profile options. You might find a dedicated section for updating your contact information. Similar to online banking, follow the prompts and provide any necessary verification.

- Phone Banking: Some banks still offer phone banking services. If yours does, call their customer service hotline and explain your request. Be prepared to answer security questions and provide your account information for verification. The representative will then guide you through the update process.

- Written Request: While less common, some banks allow you to submit a written request to change your mobile number. This usually involves drafting a formal letter stating your account details, new phone number, and reason for the change. Attach copies of your identification documents and mail it to your bank’s designated address.

Essential Documents and Information

Before embarking on your mobile number update journey, it’s vital to gather the necessary documents and information. This will not only ensure a smooth process but also save you precious time at the branch or on the phone.

- Your new mobile number: This one’s a no-brainer, but write it down and double-check it for accuracy before starting the process.

- Your bank account details: Having your account number or your bank statement handy will help the bank representative identify your account quickly.

- Identification documents: Depending on your bank’s policies, you may need to provide government-issued photo ID, such as your passport or driver’s license, for verification.

- Previous mobile number: Some banks may ask for your old mobile number for additional verification purposes.

Common Roadblocks and Tips

Even the most straightforward journey can encounter a few bumps along the way. Here are some common roadblocks you might face and how to tackle them:

- Lost or inactive old phone number: If you no longer have access to your old phone number, explain the situation to your bank representative. They may request additional verification steps, such as confirming your address or having you answer security questions linked to your account.

- Joint account updates: If you have a joint account, both account holders may need to be present in person or provide their written consent for the mobile number update.

- International numbers: Updating to an international number may require additional verification steps or may not be possible depending on your bank’s policies.

Remember, communication is key. If you encounter any difficulties, don’t hesitate to ask the bank representative for clarification or assistance.

Tips for a Smooth Transition:

- Inform your bank well in advance, especially if you use your old number for recurring payments or automatic transfers. This gives them time to update your details and avoid any disruptions.

- Back up your important bank-related data before making the change. This includes transaction statements, account numbers, and any online banking login information.

- Double-check your new mobile number for typos before submitting it. A single misplaced digit could lead to a world of financial woes!

- Monitor your bank account for any suspicious activity after the change. It’s always better to be safe than sorry.

Beyond the Update: Protecting Your Account

Updating your mobile number is crucial for receiving important bank notifications and securing your account. Here are some additional tips to stay vigilant:

- Double-check your information: Ensure your new phone number is accurate to avoid any delays or complications.

- Be wary of phishing scams: Never share your bank account details or one-time passwords with anyone over the phone or email, even if they claim to be from your bank.

- Enable two-factor authentication: Many banks offer an extra layer of security through two-factor authentication. This typically involves receiving a one-time password on your mobile phone to confirm your identity during critical transactions.

- Monitor your account regularly: Regularly checking your account statements and online banking activity can help you detect any suspicious activity early on.

- Update other linked accounts: Update your new phone number on any other accounts linked to your bank, like credit cards or payment platforms.

You may also read: How to Stop OTP/SMS Bombing: Tips to Protect Your Mobile Number

Remember: To change mobile number in bank account is a simple process with the right information and a bit of preparation. By following these steps and keeping these tips in mind, you can ensure a smooth transition and keep your finances flowing like a well-oiled machine, even when your phone number takes a detour. So, go forth and conquer those digits with confidence!

Closing Remarks: Staying Connected, Staying Secure

Keeping your mobile number linked to your bank account is crucial for convenience, security, and peace of mind. With the information and tips provided in this guide, you can confidently change mobile number in bank account and ensure your connection with your bank remains as strong as ever. Remember, staying informed and vigilant ensures your financial journey is smooth and secure, no matter how often your phone number changes along the way.

FAQ

Q. How many days it takes to change mobile number in bank account?

When updating your mobile number through online channels, the bank typically processes the request within a few hours and completes it within 3 days. Alternatively, for offline methods, the processing time for the mobile number change application may extend to approximately 14 days.

Q. Can I change my bank mobile number from home?

To modify the mobile number associated with your bank account, please reach out to your bank directly. If you have activated online banking, you can easily update your mobile number by logging into your bank’s personal banking website. Alternatively, if you haven’t activated online banking, you will need to visit a branch of your bank in person.

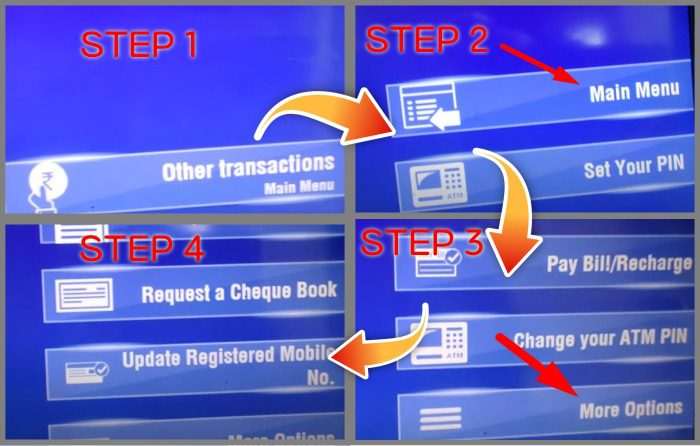

Q. Can I change mobile number at ATM?

Yes, you can change your mobile number at an ATM, but the specific process will depend on your bank. Here’s a general outline:

1) Check if your bank allows mobile number change through ATM

2) Locate an ATM of your bank

3) Insert your debit card and enter your PIN

4) Select “Mobile Number Registration” or “Change Mobile Number”

5) Enter your old and new mobile numbers

6) Verify with OTP

7) ATM will display a confirmation message

Q. How many times we can change mobile number in bank account?

There is no restriction on how often we can update our mobile number with the bank. However, to make such changes, a visit to the branch is mandatory, where you need to submit a written request. Your mobile number will only be updated after verifying your credentials. Note: The opinions expressed here are personal.

Additional Resources

- Change of mobile number through Internet Banking

- How to Update Contact Details

- 3 easy ways to change mobile number in your bank account

Hi I am Harish. I am a blogger, writer. I am also a photographer. I love to share my thoughts and experiences through the words in my blog. Thank you.

Hi to all, how is all, I think every one is getting more from

this web page, and your views are fastidious in support

of new viewers.

Thankyou for all your efforts that you have put in this. very interesting information.