Welcome to the world of digital transactions powered by Unified Payments Interface (UPI). In this guide, we’ll delve deep into the realm of UPI verification, breaking down its significance and providing easy-to-follow instructions for a seamless verification process.

What is UPI Verification?

Before we get into the nitty-gritty of UPI verification, let’s understand what it’s all about. UPI verification is basically the process of confirming your identity and bank details to make sure your digital transactions are safe and smooth. It’s like a security guard for your online payments, keeping fraudsters at bay and ensuring your money stays where it should.

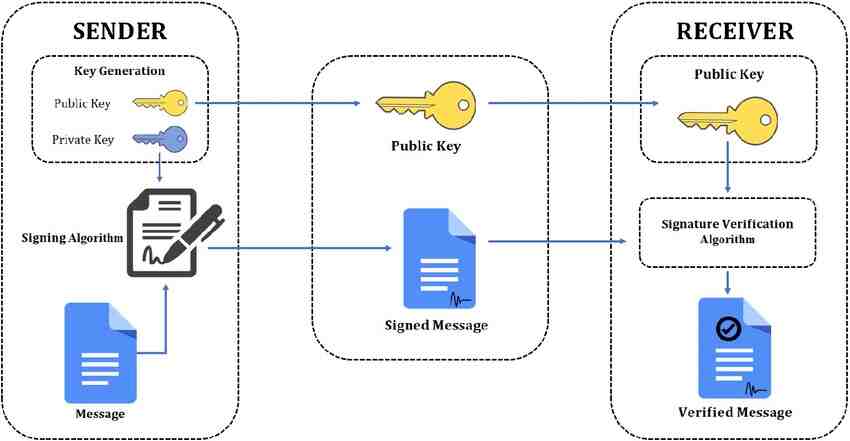

Photo Courtesy: researchgate.net

There are two main types of UPI verification:

- Transaction Verification: This checks the details of a specific UPI transaction before it’s authorized. It usually involves confirming the recipient’s name, the amount being sent, and any additional info.

- UPI ID Verification: This confirms the existence and ownership of a specific UPI ID, making sure you’re entering the correct UPI ID for your intended recipient.

Also Read: Fake UPI Payment: 11 Safety Tips to Spot & Avoid The Fraud

Why is UPI Verification Important?

Now, you might be wondering, why is UPI verification such a big deal? Well, in today’s digital world, it’s all about trust and security. UPI verification acts as a shield, protecting your hard-earned cash and personal info from falling into the wrong hands. Knowing your transactions are verified adds an extra layer of security and peace of mind when using UPI for digital payments. Without it, you’re practically inviting fraudsters to come in easily and cause a lot of damage to your money.

Also Read: How to Spot A Fake UPI ID? Examples, Risks & Prevention

How to do UPI Verification?

Alright, let’s get down to business. Here’s a step-by-step guide to UPI verification:

- Choose Your UPI App: Start by picking a reliable UPI-enabled app from your bank or a trusted provider.

- Setting Up Your UPI Account: Follow the app’s instructions to set up your UPI account, linking it securely to your bank.

- Verify Your Mobile Number with OTP: Once you’ve entered your mobile number, you’ll get a one-time password (OTP) for verification. Just punch it in and you’re good to go.

- Confirm Your Bank Details: Double-check that all your bank info is spot on before hitting the confirm button. Accuracy is key here.

- Complete the Verification Process: Follow the remaining steps on the app to finish up the verification process. This might involve setting up a UPI PIN or some extra security measures for added peace of mind.

UPI Verification Online

Thanks to the wonders of digital banking, you can now do your UPI verification online. No more long queues or paperwork – just fire up your app, and you’re good to go. Whether you’re at home or on the move, it’s as easy as pie.

Transaction Verification:

Initiate a UPI Payment: Enter the recipient’s UPI ID, amount, and any extra info in your UPI app.

Review Details: Before proceeding, your UPI app will show the beneficiary’s name associated with the entered UPI ID. This is your first step in verification.

Verify and Confirm: Check the displayed beneficiary name, amount, and any extra details. If everything matches your intended recipient, go ahead with the transaction. If there’s a mismatch, hold off and contact the intended recipient to confirm their UPI ID.

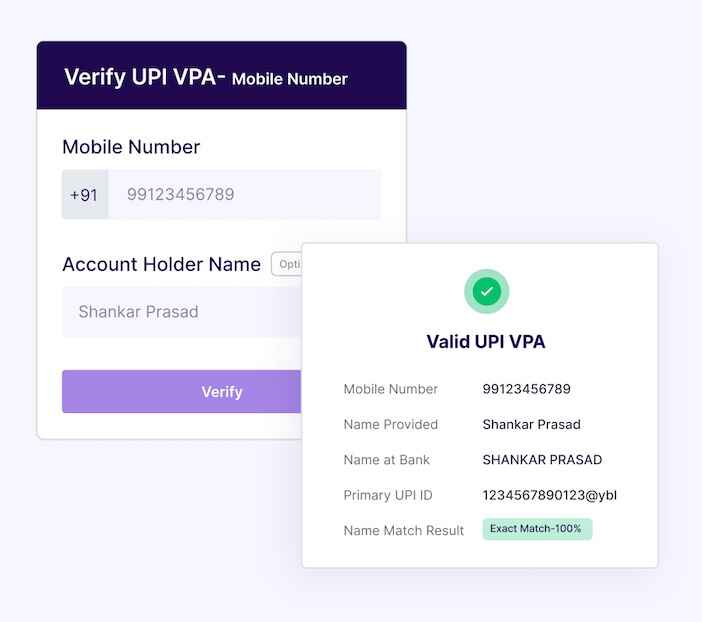

UPI ID Verification (Some Apps May Offer):

Access Verification Option: Look for a dedicated “UPI ID Verification” or similar option within your UPI app.

Enter UPI ID: Input the UPI ID you want to verify.

Verification Results: The app may display the name associated with the UPI ID, confirming its existence and ownership.

It’s worth noting that not all UPI apps offer a dedicated UPI ID verification feature. However, the transaction verification process itself serves as a basic form of ID verification.

How do I Verify UPI in GPAY?

GPay, a popular UPI app, doesn’t have a standalone UPI ID verification feature. However, it prioritizes transaction verification. When making a payment, GPay displays the beneficiary’s name associated with the entered UPI ID. Before confirming the transaction, make sure this name matches your intended recipient.

Also Read: Which Payment System is Better: Paytm, PhonePe, Google Pay, Bharat Pay, or Any Other?

How to Verify a UPI Transaction?

Once your UPI details are all verified, keeping tabs on your transactions is a piece of cake. Just double-check all the details – like the recipient’s UPI ID and transaction amount – before hitting send. Some apps even offer extra security features like biometric verification or UPI PINs for added peace of mind.

What is UPI ID Validation?

UPI ID validation is basically a fancy term for making sure a UPI ID is legit before sending any money. It’s all about double-checking to make sure you’re sending your hard-earned cash to the right person and not some random scammer.

Verify UPI ID Online for Free

There’s no central online portal for free UPI ID verification in India. UPI verification primarily occurs within your chosen UPI app during the transaction process. It’s best to avoid third-party websites or apps claiming to offer free UPI ID verification, as they could be potential scams.

UPI Verification API

UPI Verification APIs are tools used by businesses and developers to integrate UPI verification functionalities within their platforms. These APIs typically require registration and authorization from the National Payments Corporation of India (NPCI) and are not meant for individual user verification.

UPI Verification App (Not Recommended)

Similar to the caution around online verification, there might be apps claiming to offer UPI ID verification. However, these apps pose a security risk. Verifying UPI IDs should ideally happen within your trusted UPI app during the transaction process. Downloading third-party apps for verification exposes your device and UPI details to potential vulnerabilities.

UPI Verification Tools and Best Practices:

While free UPI verification APIs aren’t readily available for individual users, there are alternative tools and best practices you can use to ensure secure transactions:

Official UPI Apps: Always use verified and official UPI apps downloaded from trusted app stores (Google Play Store or Apple App Store). These apps have built-in security measures and prioritize verification during transactions.

Multi-Factor Authentication (MFA): Enable MFA on your UPI app for an extra layer of security. This typically involves verifying your identity with a one-time password (OTP) received via SMS or generated within the app.

Review Transaction History: Regularly review your UPI transaction history within your app. This helps identify any suspicious activity and allows you to report discrepancies promptly.

Beware of Social Engineering: Never share your UPI PIN, OTPs, or other sensitive information with anyone. Phishing scams often try to trick users into revealing this information.

Beyond Verification: Additional Security Tips

Here are some extra security tips to keep your UPI transactions safe:

Strong UPI PIN: Choose a strong and unique UPI PIN that’s difficult to guess. Avoid using birthdays, anniversaries, or easily identifiable sequences.

Secure Device: Use a strong password or PIN to lock your smartphone and avoid using public Wi-Fi networks for UPI transactions.

Update Apps: Regularly update your UPI app and phone’s operating system to benefit from the latest security patches.

Report Suspicious Activity: If you suspect any fraudulent activity on your UPI account, immediately report it to your bank and the UPI app provider.

To Sum Up

UPI verification is crucial for safe and secure digital payments. By understanding the different verification methods, using the right tools, and following best practices, you can minimize the risk of fraud and enjoy the convenience of UPI with peace of mind. Remember, staying vigilant and informed are key to a secure UPI experience

Hi I am Harish. I am a blogger, writer. I am also a photographer. I love to share my thoughts and experiences through the words in my blog. Thank you.

I really appreciate this post. I have been looking all over for this! Thank goodness I found it on Bing. You’ve made my day! Thx again